Grants

Capital and operating grants help Craft3 build capacity, capitalize loans, offer lower rates to borrowers, and provide additional business services.

Grants

Capital Grants

Capital grants from foundations and other organizations support Craft3’s loan capitalization and credit enhancement of loan products. These funds reduce our overall cost of capital, which supports our ability to offer more accessible and affordable rates and terms for our borrowers.

Capital grants can provide “patient” capital which allows Craft3 in some instances to offer more advantageous loan terms to individual borrowers or to revolve funds so that we can help more borrowers over time. Grants also contribute to Craft3’s net assets, which we can leverage with public and private debt to increase capital available to serve a greater number of clients. In all of these ways, capital grants help Craft3 have a greater impact.

Grants

Operating Grants

Operating grants from foundations and other organizations cover a significant portion of Craft3’s operating expenses not paid for by earnings. Craft3 strives to improve the overall functioning of regional markets in several ways. We help our borrowers grow their businesses and stabilize their finances so they can become eligible for bank or credit union financing. We also develop new products to support marginalized people and businesses who are not well served by conventional financing.

We work in markets that are underserved by traditional financial institutions. While this can mean more time, more effort, more accommodations, and higher operating costs, Craft3 does not seek to be 100% self-supporting by passing along all these costs to its borrowers.

In addition to providing capital, Craft3 offers services to its borrowers and partners including financial coaching, advising, referrals to subsidized business services, and more. These services, along with outreach to underserved communities, are costly and we rely on philanthropic support to fund them.

Finally, operating grants often fund Craft’s measurement and evaluation efforts as well as technology enhancements to increase security, efficiency, and improve customer experience.

Customer Stories

Shari'a-Compliant Real Estate Financing

Innovative Sharia-compliant real estate financing let Cordoba Academy, an Islamic school and community organization located outside Seattle, buy a building and grow. Rather than charging interest—forbidden by Islamic law—the transaction was structured through shared ownership.

Grants

Unlocking Opportunity

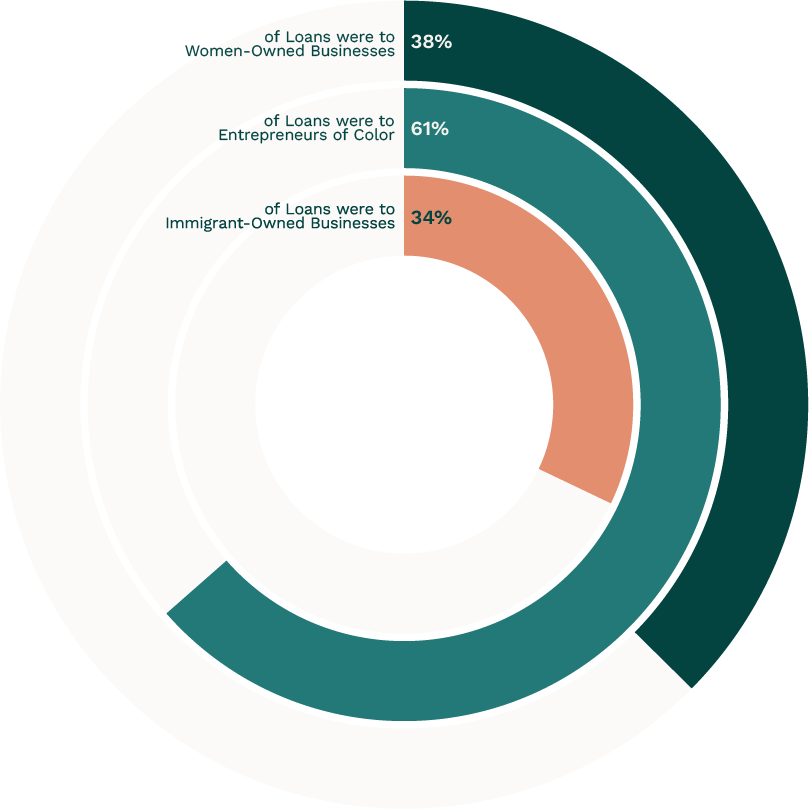

Since 1994, Craft3 has made over 1,200 loans to entrepreneurs of color and indigenous-, woman-, immigrant- and veteran-owned businesses.

In 2024, Craft3 made over $33 million in commercial loans.

Grants

Current Grantors

as of 01/24/2025

- City of Seattle, Wash.

- JPMorgan Chase Foundation

- Multnomah County, Ore.

- Northwest Area Foundation

- Oregon Housing and Community Services

- State of Oregon Department of Environmental Quality

- State of Washington Department of Commerce

- State of Washington Department of Ecology

- The Chicago Community Trust

- The Oregon Community Foundation

- U.S. Bank Foundation

- U.S. Department of Treasury, CDFI Fund

- Washington County, Ore.

GRANTS

Connect with Craft3

If you have a question, something you’d like to discuss, or want to learn more, please use the form below to email us. We aim to respond within two business days.

Our Team

"Coming from a corporate bank, I wanted to work for a company that was dedicated to building equity and resilience within the community and knowing that what I do makes a difference."

Nate Turner

Loan Servicing Team Manager, VP